| Having trouble viewing this email? Click here |

|  |

| Action Insight | Candlesticks Trades | Markets Summary | Action Bias | Top Movers | Daily Technicals |

| Calendar | Elliott Wave Trades | Markets Volatility | Pivot Points | Heat Map | Daily Fundamentals |

| Action Insight Market Overview | Markets Snapshot |

Daily Report: Euro Jumps on Irish Bailout, New Zealand Dollar Sinks on Rating Outlook DowngradeEuro gaps higher as the week opens on news that Ireland has finally sought bailout from EU/IMF to tackle its banking and budget crisis. Irish Finance Minister Lenihan said Ireland needed less than EUR 110b to use as a credit line for the state-backed banks and the loan facility could last between three to nine years. Lenihan said the funds would be a "contingency" for banks to borrow and would "not necessarily" be used. He said that banks were "too big a problem" and the government must " ensure that we do not have a collapse of the banking sector." Though, he also emphasized that the government's own operations are fully funded through mid 2011. While Euro is broadly higher today to sustainability of the rally is in question as firstly, conditions for the bailout are still unknown. secondly, markets would possibly start to speculation bailout for other countries like Portugal or Spain. | |

| Featured Technical Report | |

EUR/JPY Daily OutlookDaily Pivots: (S1) 113.72; (P) 114.01; (R1) 114.50; More EUR/JPY's rise from 111.03 extends further to as high as 114.84 so far today and at this point, intraday bias remains on the upside for 115.40/65 resistance zone first. Decisive break there will confirm that consolidation pattern from 115.65 has completed at 111.03 already and whole rebound from 105.42 has resumed for 38.2% retracement of 139.21 to 105.42 at 118.32. On the downside, 113.79 minor support will turn intraday bias neutral first. But we'd continue to favor an upside breakout as long as 111.03 support holds. |

| Forex Brokers | ||||||

|

| Economic Indicators Update | | |||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Candlesticks and Ichimoku Intraday Trade Ideas | ||||||||||||||||||||||||||||

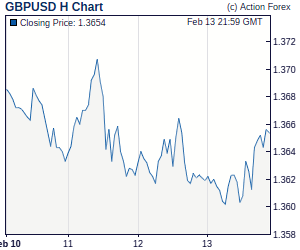

Trade Idea: GBP/USD – Sell at 1.6055Although the British pound staged a rebound after Friday's selloff from 1.6095 to 1.5936, reckon upside would be limited to 1.6055/60 and said resistance should continue to hold, bring another retreat to the Ichimoku cloud bottom (now at 1.5956) but break of said support at 1.5936 is needed to add credence to our view that the correction from 1.5840 has ended at 1.6095 and bring a subsequent retest of this level later. Trade Idea: EUR/USD – Sell at 1.3790Although the single currency has eased after rising to 1.3768, reckon pullback would be limited to the Tenkan-Sen (now at 1.3728) and one more rise to previous resistance at 1.3777 cannot be ruled out, however, loss of near term upward momentum would limit upside and resistance at 1.3822 should hold, bring retreat later. Candlesticks Intraday Trade Ideas Update Schedule (GMT): Elliott Wave Daily Trade Ideas Update Schedule (GMT): | ||||||||||||||||||||||||||||

| Suggested Readings | ||||||||||||||||||||||||||||

Fundamental Highlights

Technical Highlights | ||||||||||||||||||||||||||||

| ||||||

0 comments:

Post a Comment